MetaStock Dips 3% Despite Beat on Q4 Revenue – Is META Undervalued?

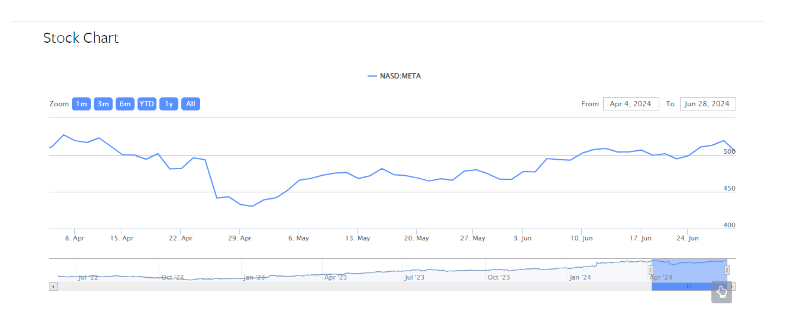

Meta Platforms, Inc. (NASDAQ: META) stock closed at $504.22 on June 28, 2024, down 2.95% from its previous close of $519.56.

This dip in the FintechZoom Meta stock price came despite another quarter of strong financial performance and user growth for the tech giant.

Let’s take a deeper look into Meta’s key metrics and analyze what this recent dip could mean for investors.

Source: https://investor.fb.com/

Stock Valuation

Based on its closing price of $504.22 on June 28, 2024, Meta is trading at a forward price-to-earnings (P/E) ratio of 17.8x based on consensus EPS estimates of $28.35 for 2024.

This is lower than the tech sector average of around 23x and Meta’s own 5-year average P/E of roughly 25x.

On a price-to-sales basis, Meta is trading at 4.5x estimated 2024 revenues, again below its historic average of 5-6x revenues given its slower revenue growth outlook.

The company’s EV/EBITDA multiple of 12.6x also represents a slight discount to its peer median and its own long-term average of roughly 15x.

While Meta faces business model challenges and higher costs in the near-term, the stock appears attractively valued given the company’s massive scale, ongoing revenue growth, and strong free cash flow generation powering dividends and buybacks over the long run.

At current valuation levels, the market appears to be discounting some of the macroeconomic uncertainties. However, the stock could see renewed upside if Meta delivers on management’s execution priorities around driving efficiencies and investing strategically in the metaverse.

Revenue and Profits Soar

In its fourth quarter and full year 2023 results, Meta posted revenue of $40.11 billion and $134.90 billion respectively, representing year-over-year growth of 25% and 16%.

More impressively, net income skyrocketed 201% and 69% for the same periods to $14.01 billion and $39.10 billion.

Operating margins of 41% and 35% demonstrate Meta’s continued ability to effectively monetize its platforms.

Diluted earnings per share of $5.33 and $14.87 for Q4 and FY2023 grew 203% and 73% and highlight the company’s growing profitability.

User Engagement Trends Upwards

Daily and monthly active users of Meta’s family of apps increased 8% and 6% year-over-year to 3.19 billion and 3.98 billion respectively.

Facebook monthly and daily users also grew 3% and 6% to 3.07 billion and 2.11 billion.

Advertising metrics like ad impressions and average price per ad rising 21% and 2% indicate Meta’s platforms remain strong for advertisers.

The company is effectively monetizing and optimizing its massive user base.

Possible Causes for the Dip

While Meta’s financial performance remains impressive, the recent stock dip could be attributed to:

- Rising inflation and recession fears weighing on overall market sentiment

- Concerns around costs of Reality Labs investments impacting future profits

- Regulatory risks from ongoing antitrust lawsuits and app tracking changes

- Currencies headwinds potentially pressuring international revenue

- Margins returning to more “normal” levels post-pandemic surge

Outlook

Barring an unforeseen macro shock, Meta seems well-positioned to continue delivering strong top and bottom line growth over the long run, supported by its large user base and ongoing monetization efforts.

However, near-term volatility related to economic and political factors may cause temporary share price fluctuations. Investors with a long-term horizon seem well-advised to look past short-term dips in what remains a very profitable company.

Conclusion

While Meta Platforms posted another quarter of impressive financial results, its stock price fell nearly 3% as recession worries weighed on the market.

The social media giant grew revenue 25% year-over-year to $40.11 billion in Q4 2021 with EPS up 203% to $5.33.

However, investors appear concerned that a potential economic slowdown could threaten Meta’s advertising revenue and profitability.

Although Meta’s platforms remain enormously popular with over 3 billion monthly active users, rising inflation and interest rate hikes have investors anxious about corporate spending and consumer demand.

The stock dip offers a buying opportunity for long-term investors confident in Meta’s continued ability to adapt and monetize its massive user base. But near-term volatility is likely to continue as macroeconomic conditions evolve.